The Definitive Guide to Whole Farm Revenue Protection

Wiki Article

A Biased View of Whole Farm Revenue Protection

Table of ContentsFacts About Whole Farm Revenue Protection RevealedThe Only Guide for Whole Farm Revenue ProtectionAn Unbiased View of Whole Farm Revenue ProtectionThe Greatest Guide To Whole Farm Revenue ProtectionThe Best Strategy To Use For Whole Farm Revenue ProtectionThe smart Trick of Whole Farm Revenue Protection That Nobody is DiscussingWhole Farm Revenue Protection Can Be Fun For Everyone

Ranch as well as ranch residential or commercial property insurance covers the assets of your ranch as well as cattle ranch, such as livestock, tools, structures, installations, and also others. Consider this as industrial property insurance coverage that's solely underwritten for businesses in farming. These are the common protections you can receive from farm and also ranch building insurance. The devices, barn, equipment, devices, livestock, supplies, and machine sheds are useful assets.Your farm and also ranch makes use of flatbed trailers, enclosed trailers, or utility trailers to transport items and also devices. Commercial car insurance coverage will certainly cover the trailer however just if it's affixed to the insured tractor or vehicle. If something happens to the trailer while it's not connected, after that you're left on your own.

Workers' payment insurance offers the funds a worker can utilize to purchase medications for a work-related injury or illness, as recommended by the physician. Employees' settlement insurance covers rehabilitation.

Whole Farm Revenue Protection Can Be Fun For Anyone

You can guarantee on your own with employees' settlement insurance coverage. While purchasing the plan, service providers will offer you the liberty to consist of or omit yourself as a guaranteed.

The Single Strategy To Use For Whole Farm Revenue Protection

The ideal one for your farm vehicle as well as situation will differ relying on a number of variables. Numerous ranch insurance coverage providers will certainly additionally provide to create a farmer's car insurance policy. It can be beneficial to couple policies with each other from both a coverage and also price perspective. In some situations, a farm insurance coverage service provider will just supply specific kinds of auto insurance or guarantee the car threats that have operations within a specific extent or scale.

Whatever provider is creating the farmer's automobile insurance coverage policy, hefty and also extra-heavy vehicles will need to be placed on a industrial automobile policy. Trucks titled to a business ranch entity, such as an LLC or INC, will certainly need to be put on a business policy despite the insurance carrier.

If a farmer has a semi that is utilized for transporting their own farm items, they may be able to include this on the same commercial vehicle policy that guarantees their commercially-owned pickup trucks. Nonetheless, if the semi is utilized in the off-season to transport the goods of others, a lot of basic farm and also industrial car insurance service providers will certainly not have an "appetite" for this sort of risk.

The Basic Principles Of Whole Farm Revenue Protection

A trucking plan is still an industrial auto policy. The providers who use insurance coverage for operations with automobiles used to transport products for Third parties are typically specialized in this kind of insurance coverage. These kinds of procedures create higher risks for insurance firms, bigger case volumes, and a greater intensity of insurance claims.An experienced independent agent can aid you figure out the kind of plan with which your business automobile need to be insured as well as describe the nuanced ramifications and also insurance implications of having multiple vehicle plans with various insurance coverage service providers. Some trucks that are made use of on the farm are guaranteed on individual car plans.

Industrial cars that are not eligible for a personal car policy, however are utilized specifically in the directory farming procedures use a minimized threat to insurance companies than their commercial usage counterparts. Some carriers opt to guarantee them on a farm auto policy, which will certainly have a little different underwriting criteria and also ranking frameworks than a routine commercial vehicle plan.

Fascination About Whole Farm Revenue Protection

Kind A, B, C, as well as D.Time of day of use, usage from the home farmResidence ranch other restrictions apply limitations these types of kinds. As you can see, there are multiple types of farm truck insurance coverage policies available to farmers.

Whole Farm Revenue Protection for Beginners

It is essential to review your automobiles as well as their usage honestly with your agent when they are structuring your insurance coverage portfolio. This kind of in-depth, conversational technique to the insurance coverage purchasing process will assist to make certain that all coverage gaps are shut as well as you are receiving the best worth from your plans.Disclaimer: Details and cases provided in this content are suggested for helpful, illustratory purposes and also ought to not be taken into consideration legitimately binding.

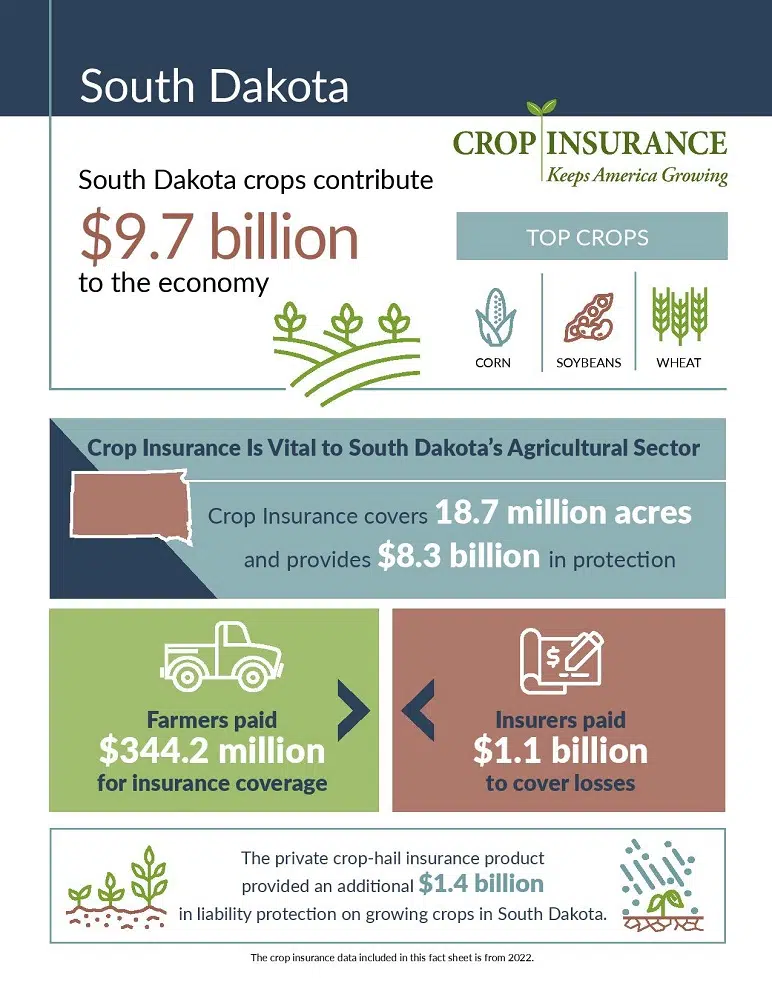

Plant hailstorm protection is marketed by exclusive insurers as well as regulated by the state insurance policy divisions. It is not part of a federal government program. There is a government program offering a selection of multi-peril plant insurance you could look here coverage items. The Federal Plant Insurance coverage program was produced in 1938. Today the RMA administers the program, which supplied plans for more than 255 million acres of land in 2010.

An Unbiased View of Whole Farm Revenue Protection

Unlike various other kinds of insurance coverage, plant insurance coverage is dependent on well established dates that use to all plans. These are the crucial dates farmers should expect to fulfill: All crop insurance Get More Info policy applications for the designated county as well as plant are due by this date.Report this wiki page